In the ever-evolving landscape of financial markets, forex software trading Trading Uganda stands out as a premier platform that embraces modern technologies to enhance trading experiences. Among the myriad of developments in this space, forex software trading has emerged as a game-changer for both novice and experienced traders. This article will delve into the benefits, functionalities, and future trends of forex software trading, providing insights into how traders can optimize their performance and exploit market volatility.

What is Forex Software Trading?

Forex software trading refers to the use of various software tools and platforms to facilitate trading performance in the foreign exchange market. These tools range from automated trading systems, trading signals, analytic software, and robust charting tools. The primary objective is to improve the trading experience by enabling traders to make more informed decisions and execute trades with precision.

The Importance of Automation

One of the most significant advantages of forex software trading is automation. Automated trading systems, commonly known as Expert Advisors (EAs), allow traders to set specific parameters for executing trades without the need for manual intervention. This capability offers several benefits:

- Time Efficiency: Traders can execute thousands of trades in a fraction of the time it would take to do manually.

- Emotion-Free Trading: Automation eliminates emotional decision-making, which can often lead to poor trading outcomes.

- Backtesting: Traders can test their strategies against historical data, ensuring that they are viable in varying market conditions.

Key Features of Forex Trading Software

When it comes to selecting forex trading software, several key features should be considered:

- User-Friendly Interface: The software should be easy to navigate even for beginners.

- Advanced Charting Tools: The ability to analyze data through complex charts is essential for making informed decisions.

- Customizable Indicators: Traders should have the option to personalize indicators based on their strategies.

- Risk Management Tools: Features for managing risk, such as stop-loss and take-profit orders, are crucial for long-term success.

- 24/7 Customer Support: Reliable customer support can help resolve issues efficiently during trading hours.

Types of Forex Software

There are various types of forex trading software available to traders, each serving different needs and facilitating a diverse range of trading strategies.

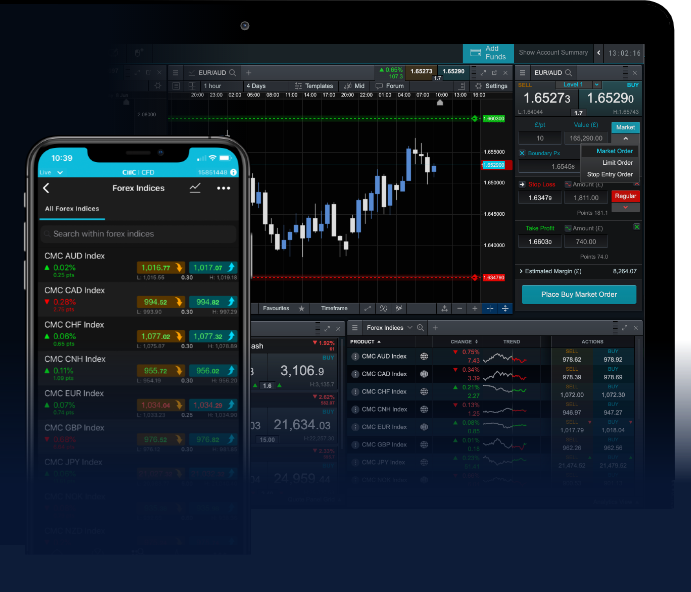

1. Trading Platforms

Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most popular trading environments. These platforms provide tools for both manual and automated trading, including comprehensive charting capabilities, technical indicators, and customization options.

2. Forex Signal Services

Forex signal services provide traders with real-time alerts about possible trading opportunities. These services analyze the market and identify trends, which helps traders to capitalize on profitable situations.

3. Automated Trading Systems

As previously mentioned, automated trading systems enable trades to be executed automatically. These systems often use algorithms to identify buy and sell signals based on predefined criteria.

4. Trading Applications

Mobile trading applications have also gained popularity, allowing traders to monitor their accounts and execute trades from anywhere, at any time.

How to Choose the Right Forex Trading Software

Choosing the right software requires thorough research and consideration of personal trading styles. Here are some tips:

- Identify Your Trading Style: Whether you prefer scalping, day trading, or swing trading, choose software that complements your style.

- Read Reviews: Look for feedback from other traders to gauge software reliability and performance.

- Trial Periods: Many platforms offer trial periods; use this opportunity to test their functionalities.

- Consider Costs: Evaluate the pricing model, including any transactional fees or subscription costs associated with the software.

Understanding Market Trends with Forex Software

Forex software trading isn’t merely about executing trades; it’s also about understanding market trends. Most trading software comes equipped with analytical tools that enable traders to anticipate market movements. By analyzing price patterns, trends, and volatility, traders can seek to enter and exit positions at optimal times.

The Future of Forex Software Trading

The future of forex software trading looks promising, thanks to advancements in technology. Machine learning and artificial intelligence are being integrated into trading software, making analysis more accurate and predictive. Here are some emerging trends to watch:

- AI-Powered Trading Bots: These bots analyze vast amounts of data to improve decision-making processes and execute trades intelligently.

- Increased Use of Cryptocurrency: As cryptocurrencies gain traction, new trading software is being developed to incorporate these digital currencies into trading strategies.

- Enhanced Security: With the increase in cyber threats, security features in forex trading software are becoming more robust.

Conclusion

Forex software trading offers a wealth of opportunities for traders willing to embrace technology. By understanding the nuances of different software options, traders can significantly enhance their market performance and achieve their financial goals. As the financial landscape continues to evolve, savvy traders will leverage these tools to gain a competitive edge, whether they are trading currencies, commodities, or even cryptocurrencies.